Fundamentals of Venture Capital Funds and Portfolio Construction🔨

Understanding the economics and strategy behind a VC Fund.

Starting the book from the end…

🤔 💭Theory:

VCs often aim for over 3x net return, which equates to a +20% Internal Rate of Return (IRR) to Limited Partners. However, achieving this estimated multiple doesn't involve investing in numerous businesses that yield 3x returns.

In the early stages, approx 2/5 of a VC portfolio will yield no returns, 2/5 will break even or return a negligible multiple, and 1/5 will generate significant returns. Generally, 10% of venture investments produce 80% of all venture returns. 🤑

⚔ Example:

A €10M fund targeting a 4x return to LPs—i.e., €40M. Initially, the firm likely won't invest the full €10M due to management fees and expenses over the fund life (usually 10y), so they may invest closer to €8M. Therefore, achieving a 4x net return requires a gross of 5x the capital invested.

Considering the power law distribution, if 10% of investments need to contribute to 80% of the entire portfolio, we're talking about €800K of invested capital generating €40M in returns—or a 50X Return on Investment (ROI)🤯. This is why every VC investment needs to have at least 50x (net) potential.

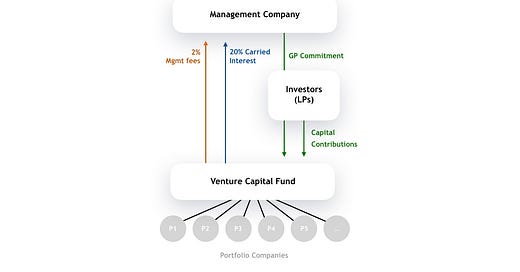

VC Funds often hang from a Management Company (regulated entity), responsible for managing a venture firm's operations across its funds, collecting fees and paying expenses.

The General Partners (GPs), are the partners who manage the fund and make the investment decisions, while the Limited Partners (LPs) are the investors who provide the capital for the fund, although GPs usually contribute with 1-5% of the total size of the Fund.

GPs typically charge 2% per year in Management Fee and 20% Carried Interest.

Management fees during the investment period usually amount 2% of the committed capital, while during the divestment period, equate to 2% of the invested capital. These fees serve to cover the operating expenses of the VC firm, such as salaries, office rent, and legal fees.

Carried interest, on the other hand, is the share of the profits that the GPs receive once the fund has returned the LPs' capital and achieved a certain level of return. The standard carried interest rate is 20%, although it can vary depending on the size and performance of the fund. In many cases in Europe, GPs commit not to charge Carried Interest until a 7% interest has been paid to the LPs (Hurdle rate).

The LPs' committed capital is disbursed quarterly based on the capital calls, over a set period of ≈10 years.

To quantify the Fund's thesis and strategy, it is convenient to craft a financial model that enables you to set clear expectations for capital allocation and return on investments.

You have to make several assumptions during the process of Portfolio Construction:

💸 Portfolio size, valuations, round sizes and target ownership.

🎓 Graduation of your portfolio: write offs, exits and successful investments.

⏰ Time to raise next round, exit or write off.

🤑 Follow on reserves.

♻️ Recycled capital (reinvest early proceeds back into new investments).

🔚 Expected Fund Performance and Returns for LPs.

The likelihood of returning less than 1x the fund decreases as the size of your portfolio grows, and gets close to zero when your portfolio exceeds 100 companies. On the other hand, enlarging your portfolio limits your potential return, because the impact of any big wins will be diluted.

From a Fund’s standpoint, follow-ons only make sense when the return of the follow-on investment alone is greater than the average return of a new initial investment.

However, from the founder's viewpoint, follow-ons are indispensable, both as a vote of confidence and extension of the runway.

Recycling all fees into new investments can be difficult to do, based on the timeframe for new investments and the timing of when proceeds happen, but funds can benefit if they manage to (re)invest in the right startups.

If you are interested in knowing more about the assumptions and fund modelling, feel free to reach out or leave a comment below!

Key Takeaways:

✅ VC is driven by a power law where a small number of companies return most profits. Without large exits, achieving venture returns is unlikely. That’s why VC isn't always the right funding choice for startups.

✅ Valuation matters: Consistently overpaying undermines your strategy. Exceptions can be made, but these decisions should be thoughtful and well-reasoned.

✅ Follow-on Investments and Recycled Capital can enhance VC Fund returns when (re)invested in the right startups, if the return on these subsequent investments is higher than the average return of a new primary investment.

✅ VC is a high risk high reward asset class and so LPs need to see a clear path to substantial returns (>3.0x net) before investing.

That’s all folks — thank you for taking a look! If you liked this post, don’t forget to follow me on LinkedIn & Subscribe for free below🔔

Crack!

Buenísimo Post Luis! Muchísimas gracias por compartirlo