List of Startups Fundraising #March 25💰

From idea-stage to Series B founders. 📣 Get exposed to an audience of over 200K readers globally, most of whom are investors.

Welcome to Learning VC💡! I’m Luis Llorens and I write monthly about venture capital, fundraising and my personal experiences as an investor. Subscribe to receive new posts and support my work:

In this post you will find a list of entrepreneurs and startups in the midst of their fundraising endeavours.

In March, we achieved solid figures:

✅ 105 startup applications.

✅ Stages: 4% Stealth | 58% Pre-seed | 30% Seed | 8% Series A & B

✅ Geographies: 43% US | 14% UK | 8% Spain | 35% Rest of the world.

🤯 431 Total submissions since Jan 2025

Fill out THIS FORM to boost your funding round, and & I will do our best to help you!

If you're a business angel or VC and would like to see the list of startups, leave a comment below or scroll to the end of this post.

I have selected 3 early-stage opportunities, each at a different stage, and provided a brief analysis.

📍 HQ: Barcelona, Spain

🏭 Industry: AI, Deep-tech, Enterprise

☘ Stage: Pre-seed

🚨 Problem: Enterprises struggle with fragmented, generic, unreliable AI solutions. Most tools look impressive in demos but fail in real-world applications.

🔛 Solution: Timbal is the end-to-end ecosystem to build, run, manage and use enterprise-ready AI applications. Our product has 2 main parts: An open-source Python framework that helps developers build AI solutions 10 times faster, and a platform that allows you to run, train, manage, and use these AI solutions.

📱 Product:

🫰 Business model: Pay per use and subscription model depending on the number of apps, knowledge bases, seats and features.

🎯 Ideal Customer Profile: Companies with a technical team (external or internal) capable of using the timbal framework by themselves.

📊 Traction: In just 4 months, they've generated over €100K in revenue and secured 9 clients, each with revenues exceeding €50M, who are actively utilizing our technology.

🏚 Market: The enterprise AI software market is estimated to be $58B in 2025, and is expected to reach $474B by 2030

👥 Marti Norberto (CEO) - Background in computer engineering and a growth hacking mindset.

👥 Isaac Grau (COO) - Telecommunications engineer and former founder of Moments/Vibras, a social app that attracted millions of users.

👥 David Bergés (CTO) - Data scientist and engineer, former founder of Moments/Vibras, a social app that attracted millions of users.

💰 Round: €500K at €3M pre-money valuation.

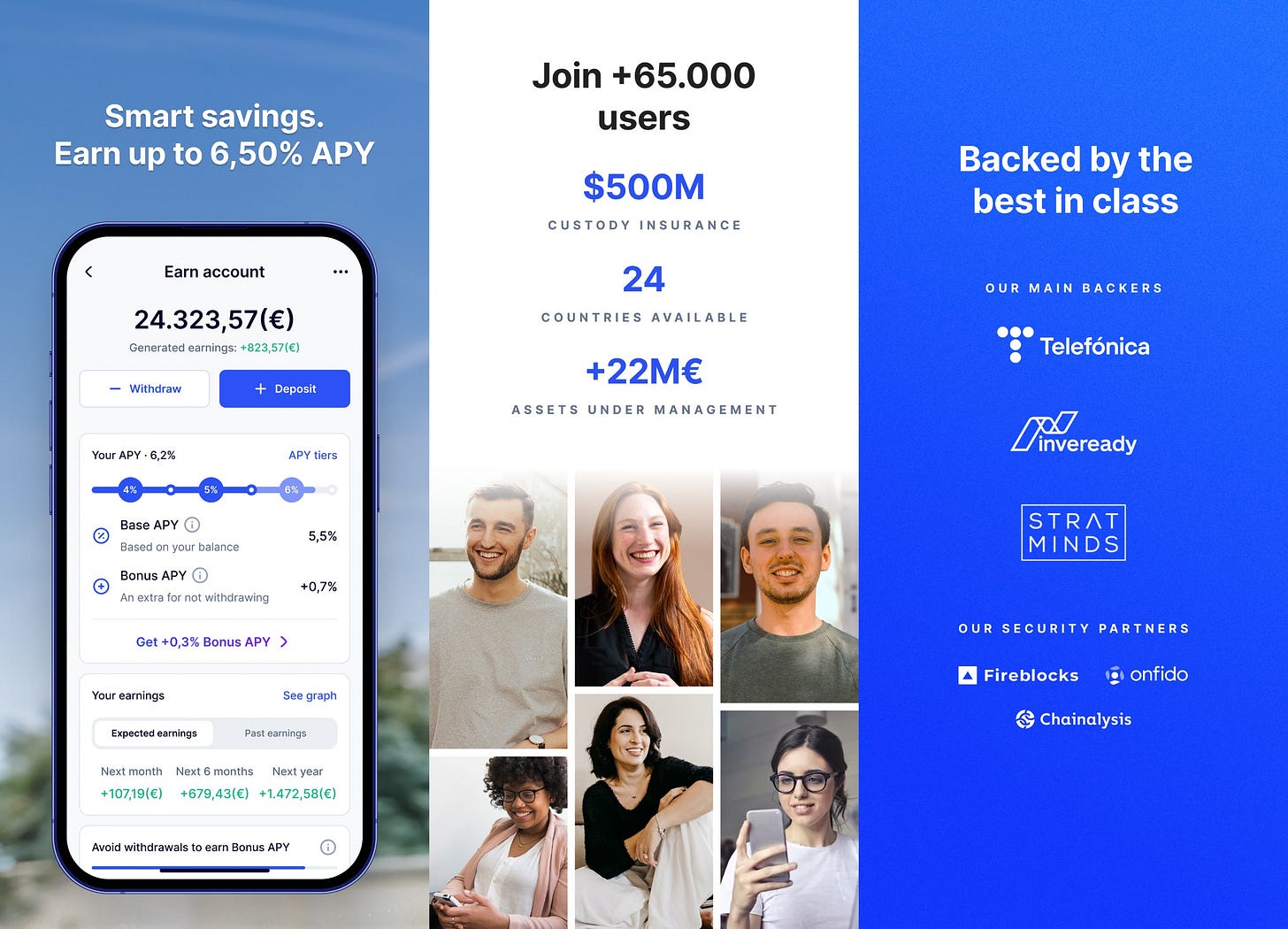

📍 HQ: Barcelona, Spain

🏭 Industry: Fintech, Blockchain

☘ Stage: Seed

🚨 Problem: European retail investors struggle to access attractive fixed-income returns. Their options are largely limited to low-yield government bonds and money market funds, leaving them excluded from the higher-yield opportunities available in private credit markets.

🔛 Solution: A simple, user-friendly platform that provides access to institutional-grade, overcollateralized private credit yields backed by digital assets.

📱 Product:

🫰 Business model: We monetize through a spread on total assets under management (AUM), capturing a share of the yield generated.

🎯 Ideal Customer Profile: Retail investors (B2C) in the EU with an average investment ticket above €3,000.

📊 Traction: Over €22 million in AUM and 15,000 active users. Growing at 3x annually in AUM.

🏚 Market: The European retail investment market exceeds €10 trillion in assets, with increasing demand for yield-driven products amid persistent low interest rates and inflation.

👥 Pol Martin (CEO) - Founded Rand at 19. Forbes 30 Under 30 Spain.

👥 Oriol Segundo (COO) - Serial entrepreneur and former founder of World Mastery, bringing deep operational experience and a track record of scaling digital platforms.

💰 Round: €2M, soft commitments received.

📍 HQ: Barcelona, Spain

🏭 Industry: Fintech, data

☘ Stage: Series A

🚨 Problem: Document and data collection and processing for financial services' core flows is still lengthy, manual and inefficient. 63% avg drop-off in "missing documentation" and 20% of the margin goes to operational costs related to documentation and data collection.

🔛 Solution: Permission-based technology to collect and process docs and data in real-time by directly connecting with private area of public authorities and other relevant sources.

📱 Product:

🫰 Business model: plans (SaaS) + usage + add-ons

🎯 Ideal Customer Profile: Financial Institutions (mid market + enterprise) such as banks, brokers, lending companies, etc.

📊 Traction: 4x in revenue in 2024, Monthly NRR of 104% in avg.

🏚 Market: Targeting a €337B market in open finance, starting in Spain, Portugal and France.

👥 Alvaro Mancilla (CEO) - Head of product at imagin (CaixaBank), CPO at Goin and founder at Workkola.

👥 Honorio Marin (CPO) - Product lead at Goin.

👥 Gabriel Esteban (CTO) - COO at Goin and full-stack developer at different companies.

💰 Round: €5M

Would you consider investing in Timbal, Rand or Bankflip?🤔 ASK ME if you want my personal feedback (POSITIVE FACTORS & CONCERNS)❗

If you’d like to be featured in my next blog post, or recurrent access to the list of startups, let me know!

📜👀 Check out the latest List of Startups in Fundraising for more opportunities that are likely still accepting funding.

If you’re not premium subscriber yet, you’re missing out! Sign up now to unlock:

List of 300+ Tech Events in Europe in 2025.

Most Popular AI Tools and Top GPTs for VCs.

Priority access to the monthly Fundraising List & Open Job opportunities.

Monthly curated dealflow: Discover startups I’m personally investing in, and potentially co-invest with me.

Full access to every issue of the newsletter.

👉 Full list for March: Here

That’s all folks — thank you for taking a look! If you liked this post, don’t forget to follow me on LinkedIn & Subscribe below🔔

Interested!

Interested!