List of Startups Fundraising #May

From idea-stage to Series A Founders. 📣Get exposed to over 100 investors globally.

In this post you will find a list of entrepreneurs and startups in the midst of their fundraising endeavours💰. Some of them have not yet obtained private funding and are at the outset of their journey.

Since April, we got:

✅ 121 startup applications.

✅ Stages: 11% idea-stage, 48% Pre-seed, 35% Seed, 6% Series A

✅ 300+ introductory emails between investors and startups.

If you want to boost your funding round, fill out THIS FORM and I will do my best to help you!

If you are a business angel or VC and want to take a look at the list of startups, leave a comment below and I will share the full list with you.

This month, I have chosen 2 startups and provided a brief analysis:

📍 HQ: Barcelona

👩⚕️ Industry: Mobility

☘ Stage: Series A

🚨 Problem: The vehicle service industry is outdated, with time-consuming, costly, and inconvenient booking processes, fragmented providers, and a reliance on offline methods. From an enterprise perspective, OEMs and dealerships face rising costs, shrinking margins and slowing sales, requiring new revenue streams and better parts distribution.

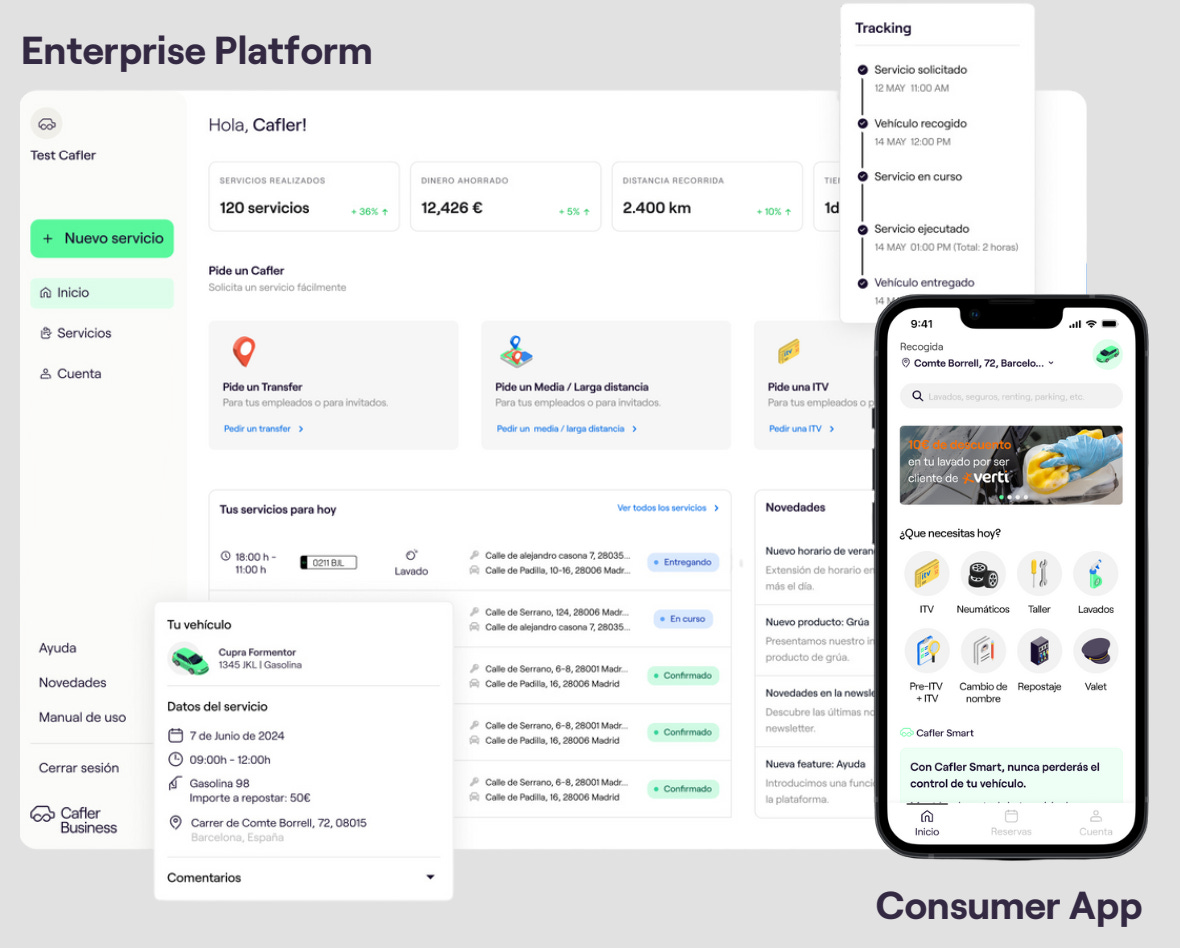

🔛 Solution: Cafler is a car services marketplace for everything that a car owner needs, and an AI operating system for mobility companies. Cafler has a B2B2C approach, enabling their partners (OEMs, Auto Shops, Fleets…) to offer their marketplace of services to their user base.

📱 Product:

🫰 Business model: Cafler implements a take rate structure, whereby partners (the service-providing companies) are charged on average 20% for each service requested via Cafler's app. When the service provided is actually performed by the OEM, Cafler charges just a mark up fee (around 5%) and the concierge service. Cafler plans to start charging for the SaaS later this year.

📊 Traction: +300k services and over the $7m revenues mark, with a 10x growth from last year.

🏚 Market: 1.4B users worldwide. Second largest household spent (12%), with a $7T headroom to grow in their core segments.

👥 Ricard Guillem (Founder) - School drop-out. He has studied in a few colleges on special programs including MIT, ESADE and currently at IESE on a scale-up founders course. Before starting Cafler, he was selected as the U18 Spanish delegate for the SDG innovation program of the United Nations.

👥 Íñigo Diego (Co-founder & CEO) - MBA from the European Business School, 10 years at Michelin occupying different positions in various countries, and founder of i-Neumaticos, the first online tire sales company.

💰 $5M round, oversubscribed.

📍 HQ: Paris

👩⚕️ Industry: Fintech

☘ Stage: Seed

🚨 Problem: African diaspora in Europe have forever been charged enormous fees to send money back to their families. On the other side, underdeveloped economies and systems make it very difficult for businesses and NGOs to send funds in and out of Africa in an efficient (financial and time) manner.

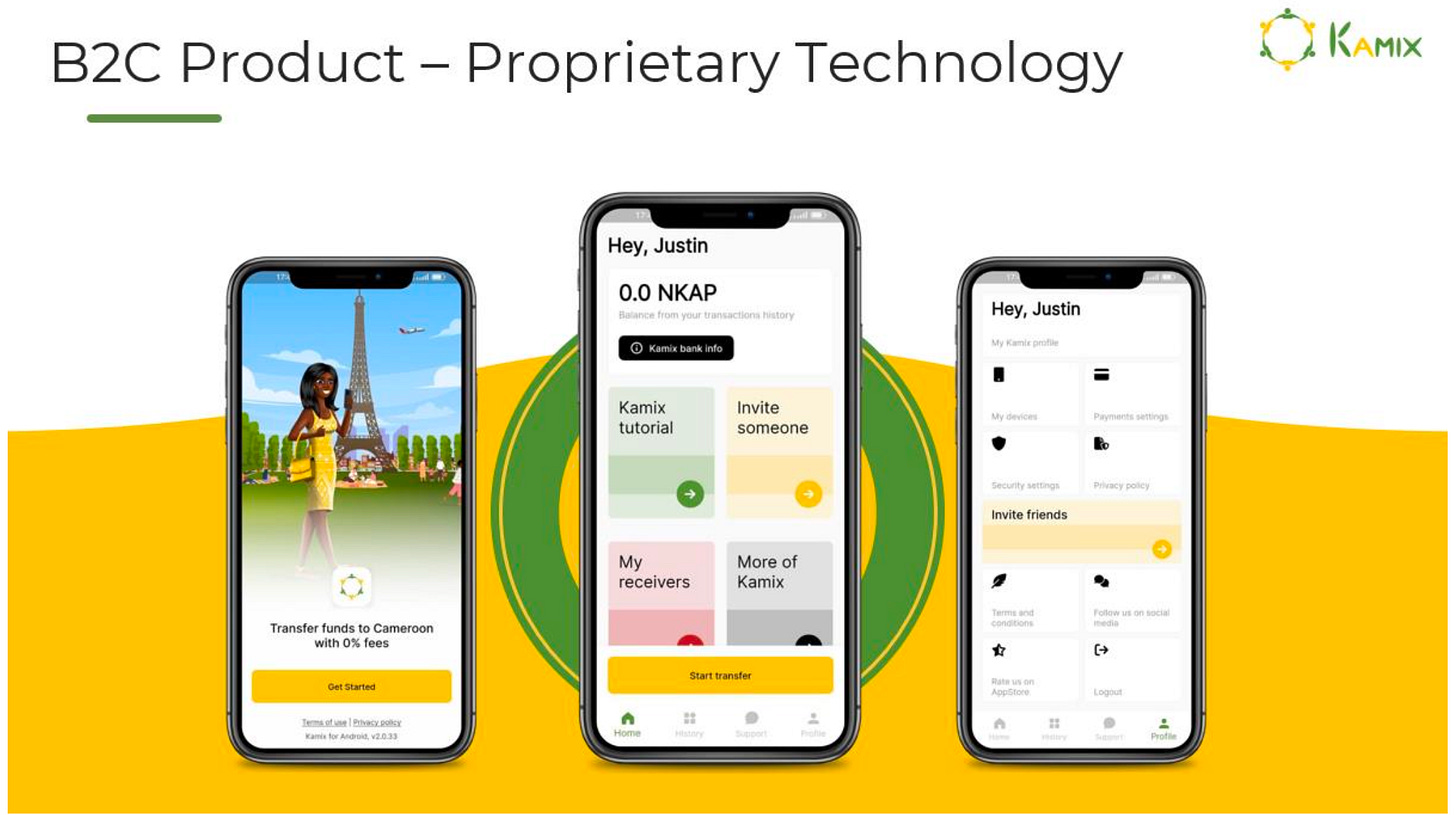

🔛 Solution: Kamix leverages on blockchain technology to be able to propose a 0% fee solution to send EUR & USD to Africa and vice-versa both for individuals and for businesses.

📱 Product:

🫰 Business model: Trading margin out of FX / remittance transactions from business and individuals. Revenue = upside achieved on FX exchange

📊 Traction: €1.6m Revenue in 2023 (x3 YoY) with 28% EBITDA margin.

🏚 Market: $400bn fund outflows from Africa and $65bn remittance inflows to Africa.

👥 Justin Lock (Founder & CEO): Engineer from Douala, HEC Paris master and Draper University graduate. As a Cameroonian who moved to Paris 10 years ago, Justin experienced 1st hand the problem Kamix is resolving and has the local network to better tailor the solution to market needs.

👥 Erik Wand (COO & CFO) - Engineer at IQS and Master’s in Finance at HEC Paris. 2 years as an investment banker in London before leading the European expansion of Boston-based Amazon aggregator Perch.

💰 Seed round in late 2024

Would you consider investing in Cafler and Kamix?🤔

If you’d like to be featured in my next blog post, let me know! Help me spread the word and get in front of 100+ investors.

That’s all folks — thank you for taking a look! If you liked this post, don’t forget to follow me on LinkedIn & Subscribe for free below🔔

What do you mean?

I am interested!