The top 3 reasons why startups fail and how to avoid them

Reflections on my investment in Gretel, a startup that ceased operations after being funded by scouts from Sequoia and Accel, Inveready, Enzo, myself, and others.

Welcome to Learning VC💡! I’m Luis Llorens and I write monthly about venture capital, investments, fundraising and my personal experiences as an investor. Subscribe to stay ahead of the curve:

In this post, I'd like to share my experience as an investor in Gretel, a B2B SaaS company that recently shut down. Additionally, I'll discuss common reasons why startups fail, along with potential solutions to avoid these pitfalls.

I met Martí, the former CEO of Gretel, in 2021 when he was working at Inveready, a Spanish VC with over €1 billion in AUM. Despite being only 23 years old with limited work experience, Martí had a remarkable drive and energy to launch his own venture. Gretel was born to stop the manual information search we all do at our jobs, and ended up being an AI-powered and data-driven platform for marketers to detect real-time anomalies and make better decision-making.

Throughout his journey, Martí successfully raised an oversubscribed round of $700K from Inveready, Enzo Ventures, scouts from Sequoia and Accel, myself, and other angel investors.

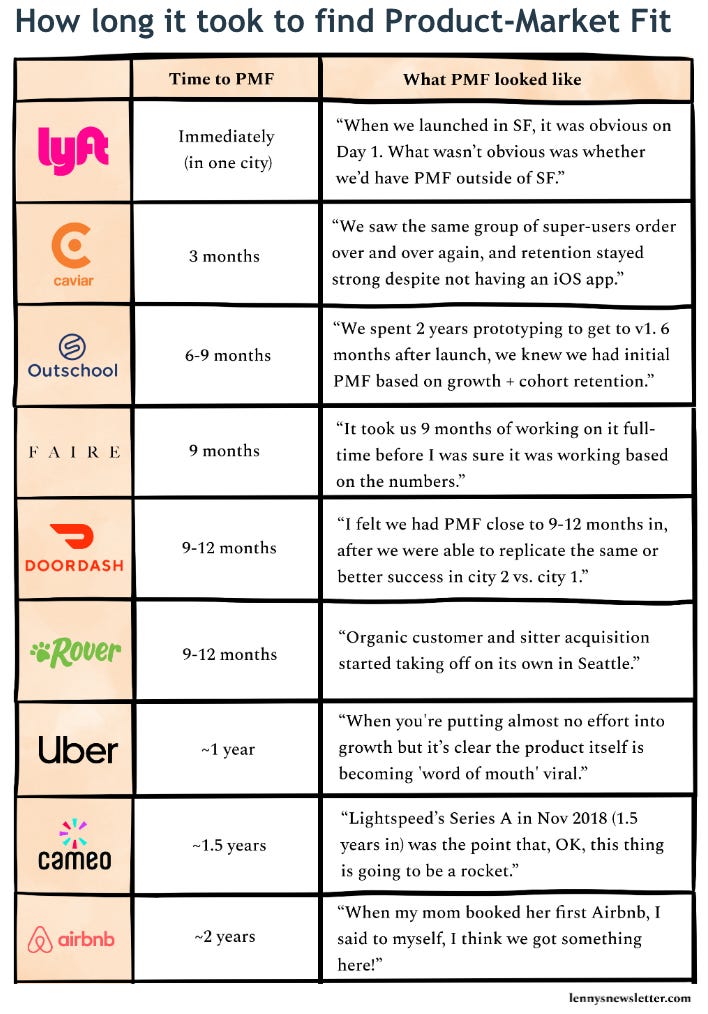

Although they pivoted and adapted the product several times to different ICPs, they weren’t able to attract customers who would pay for the solution at a venture pace. A few weeks ago, they decided to close Gretel after an unsuccessful M&A process and 2.5 years of struggling to find product-market fit. You can read the full story here.

💸 Why did I decide to invest in Gretel?

Top Founder: Martí is the kind of founder you always want to back. He is smart, resilient, transparent, and most importantly, a good person. His character stood out from the beginning.

Strong Network: Martí managed to surround himself with top BAs and VCs from the very beginning. As a relatively unexperienced investor myself, I valued that he could convince top-notch investors and former operators to join him.

Huge Market Potential: Gretel was targeting a vast market. The potential for growth and impact in the B2B SaaS space was significant, with other players in different geographies having raised millions in funding.

🎰 Why do I think it failed?

Lack of market demand: Success lies in addressing the critical issues clients are actively seeking to resolve. Gretel missed product-market fit by targeting problems that were not significant enough to ensure profitability and scalability.

Lack of (Industry) Experience: Investing in teams with prior experience managing teams and in specific industries can significantly reduce risks. Gretel lacked deep expertise in the sector to reduce frictions and accelerate revenue generation.

I don't regret investing in Martí and Gretel. Despite the company's closure, I believe in Martí's potential and would gladly invest in his next venture again.

Most startups fail. It's an unfortunate reality in the industry. According to CBInsights, most entrepreneurs close their businesses due to a Lack of Market Need, Running out of Cash, and Team Issues.

No Market Need: Entrepreneurs might have a great idea, but if it doesn’t solve a significant problem or meet a critical need for a sufficient number of customers, it won't succeed. This misalignment often stems from inadequate market research and a failure to validate the business idea with potential customers before fully committing resources.

Recommendation: Conduct thorough market research and engage in constant customer feedback loops. Validate your business idea by ensuring there’s a genuine demand and that your product or service addresses a critical pain point for your target audience. Let their struggles guide your product roadmap rather than your own assumptions. Be ready to quickly pivot based on customer feedback.

Ran Out of Cash: Many startups underestimate the amount of capital required to sustain operations and achieve profitability. Mismanagement of funds, optimistic revenue projections, and unexpected expenses can quickly drain resources.

Recommendation: Focus on generating revenue as early as possible to reduce dependency on external funding and attract investors faster. Secure enough funding to cover initial expenses and have a buffer for unforeseen costs. Manage your burn rate carefully and scale in conjunction with validated customer demand.

Not the Right Team: A lack of shared vision or values, and gaps in skills or expertise can slow progress and lead to failure. A solid, experienced, and complementary team is crucial for navigating the challenges of building a startup.

Recommendation: Ensure clear communication, set expectations, and address conflicts promptly. Work on the Shareholders Agreement as soon as possible to build a positive company culture from the very beginning. Spend time on the first hires, as they will be crucial for the success of the startup.

Startup shutdowns continue to accelerate.

According to Carta, startup founders are experiencing a fundraising crunch, leading to an increasing number of companies closing their doors🚪. This surge in shutdowns reflects the growing difficulties startup founders are facing in securing funding and sustainable growth.

That’s all folks👋 — thank you for taking a look! If you liked this post👍🩷, don’t forget to follow me on LinkedIn & Subscribe for free below🔔

Thank you for sharing it! It reflects the importance of selling and generating revenue