Venture Capital Compensation in Europe 🇪🇺 - Part 2

The UK leads, Spain lags, and more revealing insights from our recent European survey!

Welcome to Learning VC💡! I’m Luis Llorens and I write monthly about venture capital, investments, fundraising and my personal experiences as an investor. Subscribe for free to receive new posts and support my work:

I’m thrilled to share part 2 of the Learning VC & EU.VC Compensation Survey Results. I believe this is the edition most of you have been waiting for: Comprehensive compensation benchmarks for European Venture Capital roles, broken down by country.

Survey Data

We received over 400 survey responses to address a key question: What does the compensation package for European VCs look like?

This post focuses exclusively on VC compensation data, gathered from 24 European countries and 48 different cities. In a future report, we’ll explore findings from the 50+ CVC (Corporate Venture Capital) responses.

Key trends from the Data

1. Salaries by Role

Only roles with 10 or more responses are included to ensure reliability. While we received data for roles like Venture Partner, Operating Partner, Director, General Counsel, and Fundraiser, these were excluded due to small sample sizes.

The Investment Manager role stands out as a hybrid position in some funds, bridging Associate and Principal-level responsibilities.

For Head of Finance, compensation packages vary widely based on fund size and region. Most of the respondents are UK-based.

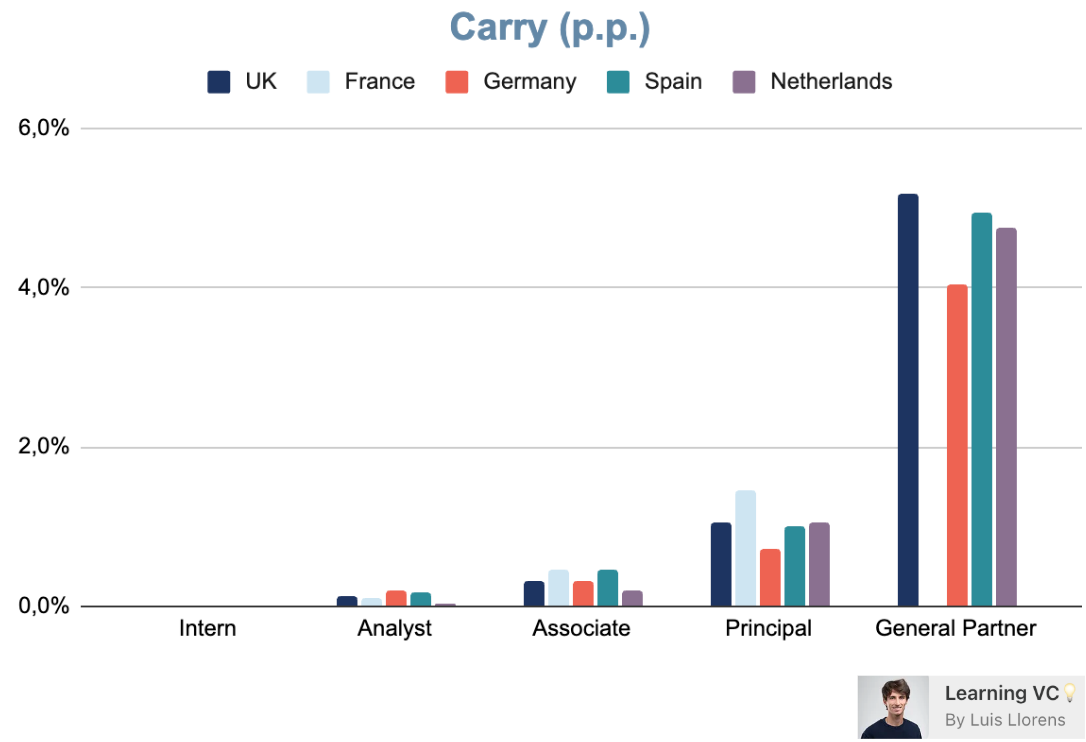

Carry increases significantly as investment professionals climb the VC hierarchy. This long-term incentive, tied to the fund’s 10-year lifespan, often becomes a defining component of General Partner compensation. It’s also used strategically as a retention tool to align key team members with fund performance.

2. Gender disparity

The industry remains heavily male-dominated, particularly at senior levels, though roles like Head of Platform and Head of Finance are more gender-balanced.

3. By Country

We received responses from numerous countries but narrowed our focus to those with a robust sample size. The analysis includes the UK, France, Germany, Spain, and the Netherlands, where we gathered at least 40+ responses per country.

*France’s GP cells are empty due to a lack of a significant sample of responses (<5).

Salaries increase steeply with seniority across all regions, with notable disparities between countries. The UK leads in salaries across most roles, followed by Germany. Spain lags behind, with notably lower base salaries for nearly all roles, except for GPs, whose compensation is in line with the average.

General Partners typically do not receive bonuses as part of their compensation. In fact, 60% of GPs do not receive a bonus, likely because they are better rewarded through carry incentives.

The UK and France stand out for Associates and Principals, offering bonuses that are twice as high as those in countries like Spain and the Netherlands, where bonuses are significantly lower

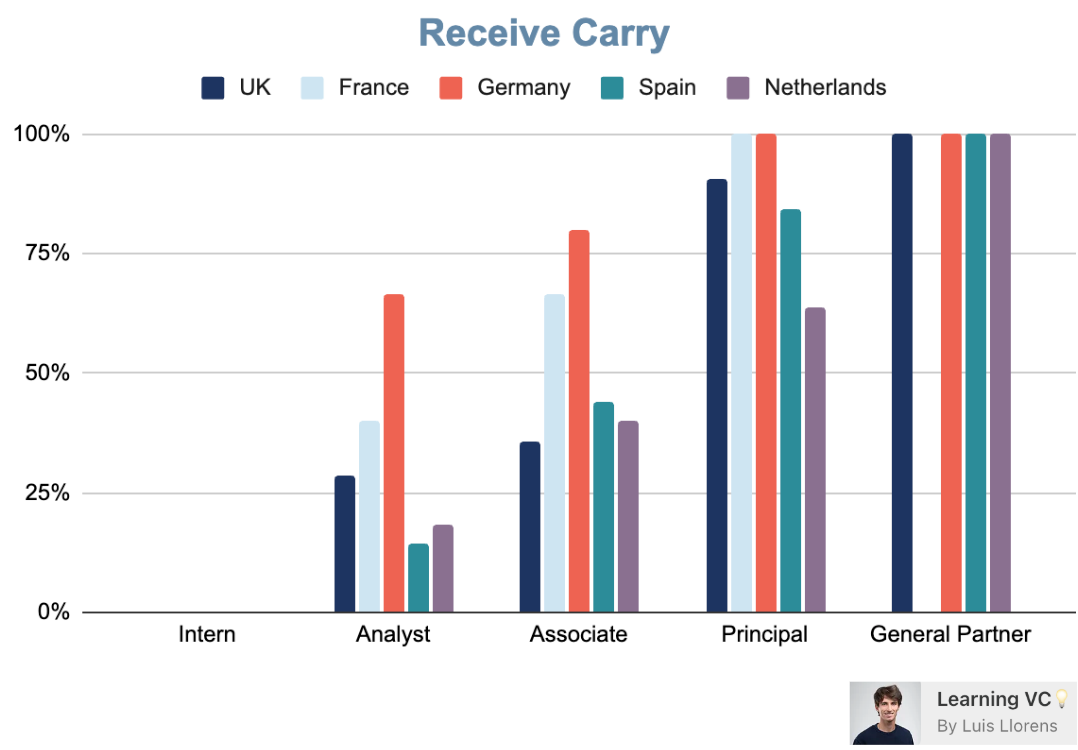

While carry percentages for junior roles remain negligible (0-0.5%), they still act as a crucial retention tool.

At the Associate and Principal levels, France takes the lead, offering competitive carry percentages that make it an attractive market for professionals seeking long-term compensation through profit-sharing.

Junior roles like Analysts and Associates are less likely to receive carry, though Germany and France have relatively higher percentages (e.g. 67% for Analysts, 80% for Associates).

Conclusions & Observations:

✅ VC is a very young sector, with General Partners —the most senior individuals—having an average age of just 42 years.

✅ The UK leads Europe in overall compensation for VC roles, while Spain lags behind in nearly all categories.

✅ Many interns are older professionals transitioning into VC, often with prior experience but needing to restart at the entry level.

✅ Compensation can vary significantly based on factors like assets under management, firm size, and location.

▶️ Improvements for next benchmark: Collect role levels and filter the data by AUM to provide a more actionable guide.

Check our previous post - Part 1 of the EU VC Salary Benchmark, for further information.

That’s all folks👋 — thank you for taking a look! If you liked this post, don’t forget to follow me on LinkedIn & Subscribe for free below🔔

Really insightful read!

This is really interesting! Be good to see how US is probably 50-75% more in median base salary, but probably top heavy - but then also probably relative based on cost of living (especially in A+ cities).